In our last Market Commentary, we discussed the relative performance of each of the four WealthCo funds through the end of May 2022. A discussion of relative performance highlights the value that an advisor is adding (or subtracting) through active management relative to what investors would typically earn through a passive indexed strategy.

June was another challenging month for publicly traded equities and fixed income as recession fears continued to rise due to inflationary pressures and uncertainty regarding rising interest rates. Fortunately, each of the four WealthCo funds significantly outperformed relevant benchmarks during June, which further extends our relative value added for the year (see footnote 1):

Our strong relative performance in down markets is very much aligned with our investment objectives. Our Fixed Income Fund is an important component of each WealthCo investor’s asset allocation, and we feature that fund in this month’s Market Commentary.

Prudent Diversification Includes an Allocation to Core Fixed Income

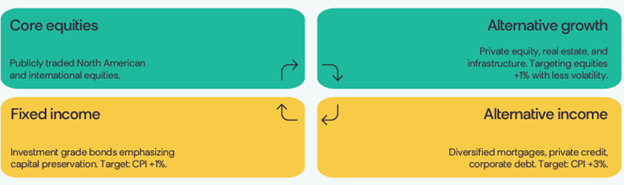

As we strive to consistently enhance diversification, manage risk, and improve outcomes, the assets of every WealthCo investor are allocated across four pooled trust funds:

But not every WealthCo investor has the same risk tolerance or return objectives. Accordingly, the allocation to each of the four trust funds varies. The illustration below outlines the allocation for new (see footnote 4):

Revisiting the Structure of the Fixed Income Fund

Dave Makarchuk, WealthCo’s Chief Investment Officer, initiated a comprehensive review of WealthCo’s fixed income fund in Q1 2022. The fund’s recent performance had been good (outperforming its benchmark by 1.5% in 2021), but Makarchuk believed that a review was still warranted.

“It is good governance to fully review the investment objectives and manager structure of a fund from time to time,” Makarchuk explains. “Given the uncertainty regarding future interest rates as well as the importance of this fund to investor’s overall portfolios, a fulsome review of manager options was appropriate.”

Significant portfolio decisions for each of the four funds must be reviewed and approved by WealthCo’s Investment Committee, and the review of the fixed income fund was no exception.

“Dave and his portfolio management team brought a set of key investment principles to the Investment Committee to discuss and agree upon,” explains David Udy, the committee Chair and WealthCo’s CEO and Founder. “We liked the fact that the primary objective of the Fixed Income Fund would now be principal safety, with ‘Consistent and Regular Investment Income’ now an important, but secondary, objective. While clients look to the other three funds for solid real returns, their risk tolerance within the Fixed Income Fund is certainly lower.”

The Investment Committee approved a target structure before the manager search commenced.

“We agreed that we wanted an investment partner who was likely to add value both in a higher rate, and a lower rate, environment,” Makarchuk shares. “Interest rates are likely to continue to rise for some time, but eventually they’ll plateau and then come back. We wanted to find a manager who would lengthen duration when appropriate to help add value, but to shorten duration when the risks of capital loss is higher.”

Evaluating Manager Options

WealthCo issued a comprehensive Request for Proposal to several managers who fit the profile of their investment objectives and thoroughly reviewed each.

“We received several excellent proposals,” Makarchuk shares, “and narrowed them down to three who made finalist presentations. The three finalists were all somewhat unique in their approach…we were impressed by the diverse perspectives they had.”

Evaluation of the proposals wasn’t based simply on one or two factors - there were many considerations.

“Manager assessment is so much more than evaluating past performance,” Makarchuk explains. “The investment strategy, the team, the portfolio construction, the research quality, risk management, and cost are most important from my perspective. Together they tend to be the best indicators of future performance. We spent a lot of time discussing how each manager researched each security, including how they incorporate Environmental, Social, and Governance (ESG) considerations. We also spent a lot of time discussing how they would manage duration and their outlook for future interest rates.”

Introducing Fiera Capital Management

While there were a number of strong proponents, Makarchuk and the Investment Committee agreed that Fiera Capital Management was the best option going forward.

“Fiera was not only the best fit for our requirements, but also proposed the lowest cost,” Makarchuk explained. “We are confident that Fiera will extend the investment philosophy that has added significant value to the fund over the last 18 months on a cost-effective and prudent basis.”

Fiera’s Fixed Income team are based in Canada and manage over $25Billion of similar strategies for a wide range of clients.

“We were impressed by the comprehensive nature of their investment strategy and their commitment to risk management,” Makarchuk explained. “Their research platform is thorough and robust with respect to both company fundamentals and ESG considerations. And the resulting portfolio, along with its permitted security limitations, give us comfort that the quality of the bond issuers will remain high going forward. Their past performance has been solid and steady, something we expect to continue going forward.”

The Transition to Fiera’s Two Pooled Funds

WealthCo client assets transitioned to Fiera over the last two weeks of June 2022.

“Fiera retained most of the bonds that were previously held in the portfolio,” Makarchuk explained, “but made some additions/changes to align the portfolio with their investment structure.”

The fixed income investments of WealthCo client assets are now held in two unitized pooled funds:

- The Fiera Integrated Fixed Income Short-Term Fund, and

- The Fiera Integrated Fixed Income Universe Fund.

At the time of this transition (June 2022), 70% of the fixed income fund was allocated to the Short-Term Fund, while 30% of the fund was allocated to the Universe Fund.

“The proportional share of each fund will change from time to time,” Makarchuk explained. “As Fiera’s views on the relative attractiveness of Fixed Income investments increase, the allocation to the Universe fund will also increase. I expect that will occur as interest rates rise even further, but their decision is based on a multitude of factors. From our perspective, this structure efficiently balances risk management with return opportunities. We are looking forward to a long and successful partnership with Fiera.”

A commitment to working with first-class managers is a key part of the WealthCo Asset Management Team’s integrated approach to ensuring a balanced and well-performing portfolio. Not only do we look for first-class managers, but also with those who align well with our investment philosophy, an investment philosophy that empowers us to consistently enhance and improve our client outcomes.

Related Posts